The CFO role has always been a pressure cooker—but today’s finance leaders face higher expectations than ever. To fulfill their charge of increasing efficiency and managing costs while driving deeper insights, CFOs understand they need to embrace the promise of AI.

The potential value is huge: generative AI can cut through lengthy reports by highlighting relevant information. It can automate repetitive manual tasks such as gathering and reconciling information at period end. It can detect anomalies and manage exceptions with lightning speed, providing real-time recommendations so teams can turn their attention to higher-value strategic work.

While the opportunity for AI in finance is nearly unlimited, it can also be overwhelming. To clarify a path forward, we created the “Global CFO AI Indicator Report: Four Steps for Finance Leaders to Expedite Time to Value with AI,” commissioned with FT Longitude. Through extensive research this global report explains AI’s impact on everyday finance duties and underscores the urgent need for finance leaders to start embracing AI and explore use cases.

In the words of Michael Schrage, a research fellow at the MIT Sloan School of Management’s Initiative on the Digital Economy, AI gives CFOs a “wonderful opportunity to revisit the fundamentals of value creation, capital allocation, capital management, and regulatory and organizational compliance.”

AI Pioneers: Paving the Way

To serve as our North Star, we separated the top third of all respondents—including CEOs and the heads of finance, IT, and HR—who responded to our survey, based on their level of AI investment and adoption maturity. This cohort, which we call the AI Pioneers, has already embraced AI to work more efficiently and create significant value.

Among AI Pioneers, 195 of those are in finance. They are working faster and more efficiently, finding more opportunities to reduce risk, and delivering significant strategic value to the business.

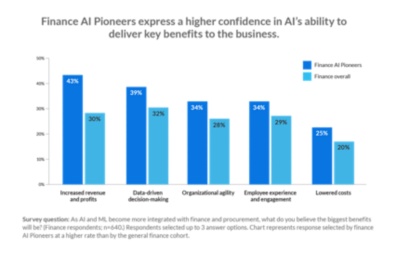

These respondents also express higher confidence in AI’s ability to deliver key benefits. Consider: more than half of finance AI Pioneers (52%) call the technology a gamechanger for the finance industry, compared to 39% of finance respondents overall. Similarly, 43% of finance AI Pioneers say AI will drive increased revenue and profits, and 39% believe it will boost data-driven decision-making, versus just 30% and 32%, respectively, of overall finance executives.